Interactive 1003 Application

Using outdated or corrupt Apple iPad 2 drivers can cause system errors, crashes, and cause your computer or hardware to fail. Manufacturer:AppleHardware Type:TabletModel:iPadSeries:2Compatibility:Windows XP, Vista, 7, 8, 10Downloads:85,089,382Download Size:3.4 MBDatabase Update:Available Using DriverDoc:Optional Offer for DriverDoc by Solvusoft This page contains information about installing the latest Apple iPad 2 driver downloads using the.Apple iPad 2 drivers are tiny programs that enable your Tablet hardware to communicate with your operating system software. Furthermore, installing the wrong Apple drivers can make these problems even worse.Recommendation: If you are inexperienced with updating Apple device drivers manually, we highly recommend downloading the. Ipad mini drivers windows 10. Maintaining updated Apple iPad 2 software prevents crashes and maximizes hardware and system performance.

The 1003 mortgage application form is the industry standard form used by nearly all mortgage lenders in the United States. This basic form, or its equivalent, must be completed by a borrower to apply for a mortgage. While some lenders may use alternative forms or simply accept basic borrower information about their identity, property type, and value, the vast majority of lenders rely on the 1003 form.

Generally, the 1003 form is completed twice during a mortgage transaction: once during the initial application and again at closing to confirm the terms of the loan. Some lenders allow borrowers to complete the form at home, while others assist borrowers in person or over the phone. In either case a potential borrower should understand the 1003 format and the information required before completing the form.

Borrowers have to complete the 1003 form twice during a mortgage transaction—once during the initial application and again at closing—to confirm the terms of the loan.

The 1003 Loan Application Form

The 1003 loan application form, also called the Uniform Residential Loan Application, was developed by the Federal National Mortgage Association, or Fannie Mae, as a standardized form for the industry. Fannie Mae and its sibling, the Federal Home Loan Mortgage Corp., or Freddie Mac, are lending enterprises created by Congress to maintain liquidity in the mortgage market. These entities purchase mortgages from individual lenders and hold the loans in their own portfolios or sell the loans to other entities as part of a mortgage-backed security (MBS). By selling consumer mortgage debt to these federally backed entities, lenders maintain the liquidity necessary to continue offering new loans.

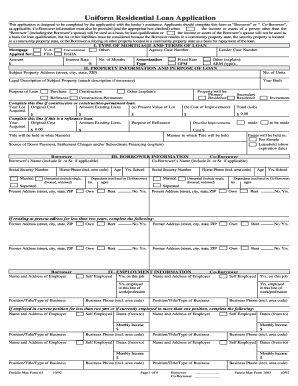

Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the lender's assistance. Applicants should complete this form as 'Borrower' or 'Co-Borrower', as applicable. Co-Borrower information must also be provided (and the appropriate box checked) whenthe income or assets of a person other than. Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev.6/09) Page 1 of 5 Fannie Mae Form 1003 7/05 (rev.6/09) Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender’s assistance. Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender’s assistance. Applicants should complete this form as “Borrower” or “Co-Borrower,” as applicable. Uniform Residential Loan Application Interactive Keywords: 1003, Selling Transactions, Loan Application.

Mortgages need to be documented in the way dictated by Fannie Mae and Freddie Mac. As both entities require the use of Form 1003—or its Freddie Mac equivalent, Form 65—for any mortgage they consider for purchase, it is simpler for lenders to use the appropriate form at the outset rather than to try to transfer information from a proprietary form to a 1003 when it comes time to sell the mortgage.

A lot of our clients ask: how can I create an interactive 1003 form? With our live forms tool you can create a uniform residential loan application form just like a Freddie Mac or Fannie Mae 1003. Simply upload a standard PDF 1003, word document, or a version tailored to your needs, add form fields and you're ready to go. Fannie Mae Form 1003 is a loan application form designed by Fannie Mae and Freddie Mac that is used by lenders to obtain financial and personal information from borrowers who apply for a mortgage loan secured by a one to four unit residential real estate. Form 1003 is also known as the Uniform Residential Loan Application (URLA). The 1003 mortgage application form is the industry standard form used by nearly all mortgage lenders in the United States. This basic form, or its equivalent, must be completed by a borrower to. This is a fillable 1003 Form in PDF format. This form has been left password free so you can print or save the document to PDF. This form is sometimes known as a 1003 Uniform Residential Loan Application. It is commonly used in real estate transactions and mortgage transactions.

Income, Assets, and Liabilities

Interactive 1003 Application Printable

The 1003 form includes all the information a mortgage lender needs to determine whether a potential borrower is worth the risk of the loan. This includes information about the borrower’s identity. While some lenders do not require employment information to consider a new mortgage, the 1003 form calls for up to two years of employment history to be entered for each borrower. This is used as a means of establishing the financial security and reliability of the borrower.

The 1003 form also requires a borrower to disclose total monthly household income, as well as regular monthly expenses. In addition to this information, the form requires an itemized list of the borrower’s assets and liabilities to determine whether he or she can afford monthly mortgage payments.

Interactive 1003 Application Pdf

Borrower assets include anything that could be used or liquidated to cover loan payments, such as checking and savings accounts; stocks, bonds, mutual funds, or other investments; IRA, 401(k), or similar retirement accounts; and life insurance policies. Lenders need to be aware of any and all debts for which the borrower may be liable, in addition to mortgage payments, such as car loans, credit card debt, student loans, or open collection accounts. If the borrower owns any other property, either as an investment or a second home, the 1003 form requires the disclosure of these assets and any mortgages that may be tied to them.